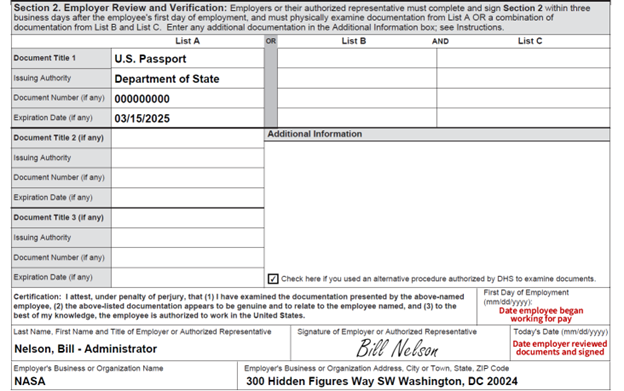

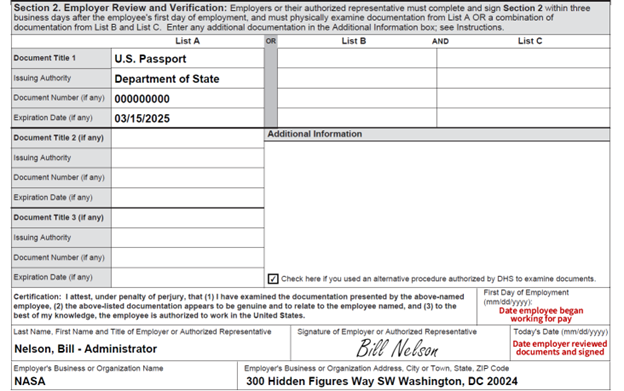

As an employer, you or your authorized representative must complete and sign Section 2 of Form I-9, Employment Eligibility Verification, within 3 business days of the date of hire of your employee (the hire date means the first day of work for pay). For example, if your employee began work for pay on Monday, you must complete Section 2 by Thursday of that week. If the job lasts less than 3 days, you must complete Section 2 no later than the first day of work for pay. Recruiters and referrers for a fee do not enter the employee’s first day of employment.

Staffing agencies may choose to use either the date an employee is assigned to the employee’s first job or the date the new employee is entered into the assignment pool as the first day of employment.

Employees must present original, acceptable, and unexpired documentation that shows the employer their identity and employment authorization. Your employees may choose to present either:

In certain cases, employees can present an acceptable receipt for List A, B, or C documents.

List A documentation shows both identity and employment authorization. If an employee presents acceptable List A documentation, do not ask them to present List B or List C documentation.

List B documentation shows identity only and List C documentation shows employment authorization only. If an employee presents acceptable List B and List C documentation, do not ask them to present List A documentation.

As an employer, you or your authorized representative must examine the documentation your employee presents, complete Section 2 and sign and date the form.

Federal contractors completing Form I-9 for existing employees as a result of an award of a federal contract with the FAR E-Verify clause (PDF):

This date is the actual date you complete Section 2 by examining the documentation your employee presents and signing the certification.

If your employee is a minor (under age 18), has a disability (special placement), or presents documents with which you are not familiar, please see Special Categories on how to complete Form I-9. If you still need help, please contact the Form I-9 Contact Center

An authorized representative can be any person you designate, hire, or contract with to complete, update, or make corrections to Section 2 (or 3) on your behalf. An authorized representative can be any member of the general public (see exception regarding employees below), personnel officer, foreman, agent, or notary public where permissible. Your authorized representative must perform all your duties, including reviewing the employee’s completed Section 1, either physically or remotely. You are liable for any violations in connection with the form or the verification process, including any violations of the employer sanctions laws, committed by the authorized representative you designate.

You are not required to have a contract or other specific agreement with your authorized representative for Form I-9 purposes. If you choose to use a notary public as an authorized representative, that person is not acting in the capacity of a notary. This person must perform the same required actions to complete the verification process on your behalf as any other authorized representative, including signatures. When acting as an authorized representative, a notary public should not provide a notary seal on Form I-9.

Employees cannot act as authorized representatives for their own Form I-9. Therefore, employees cannot complete, update, or make corrections to Section 2 (or 3) for themselves or attest to the authenticity of the documentation they present. See the M-274, Handbook for Employers for additional information.

More Information