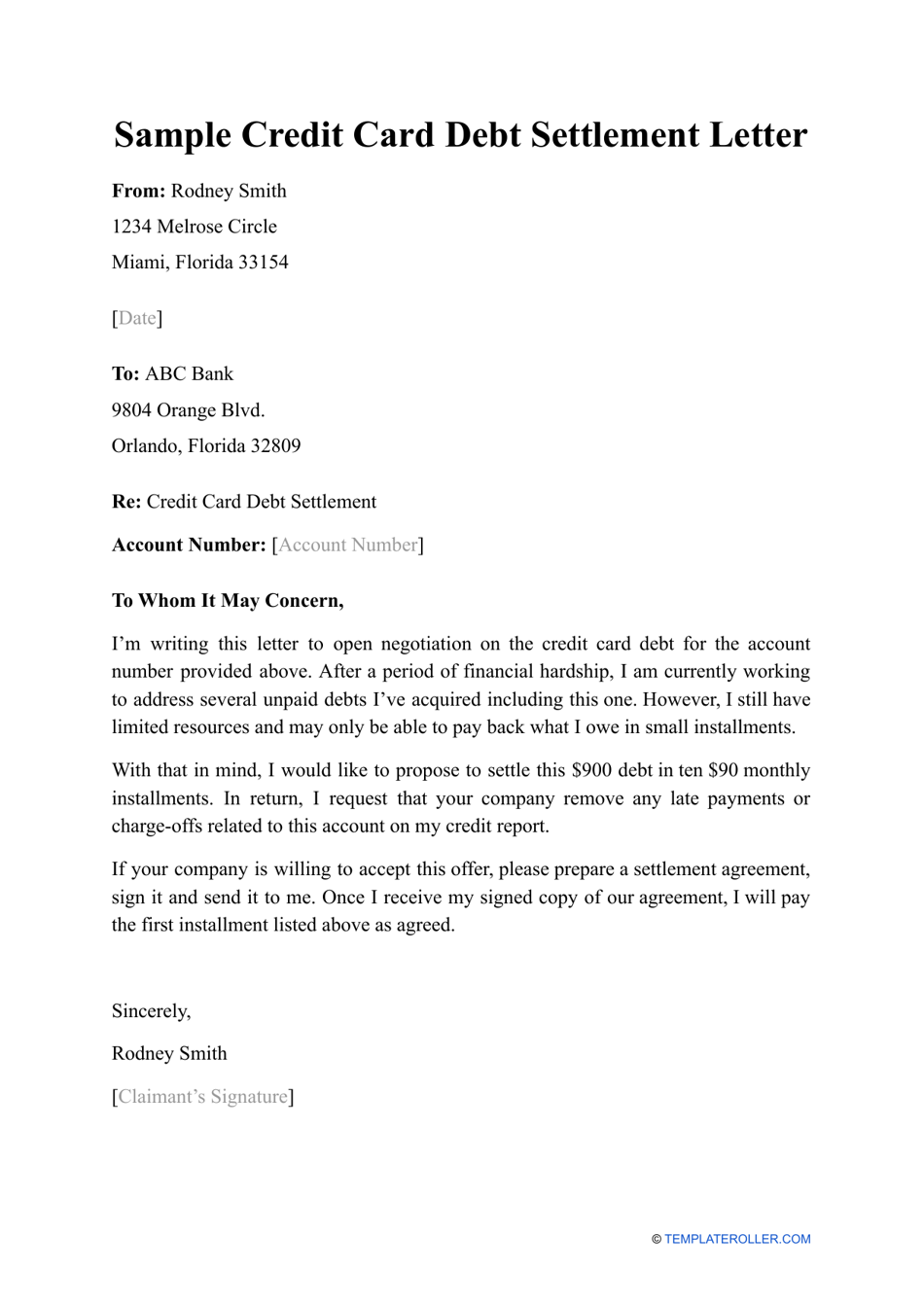

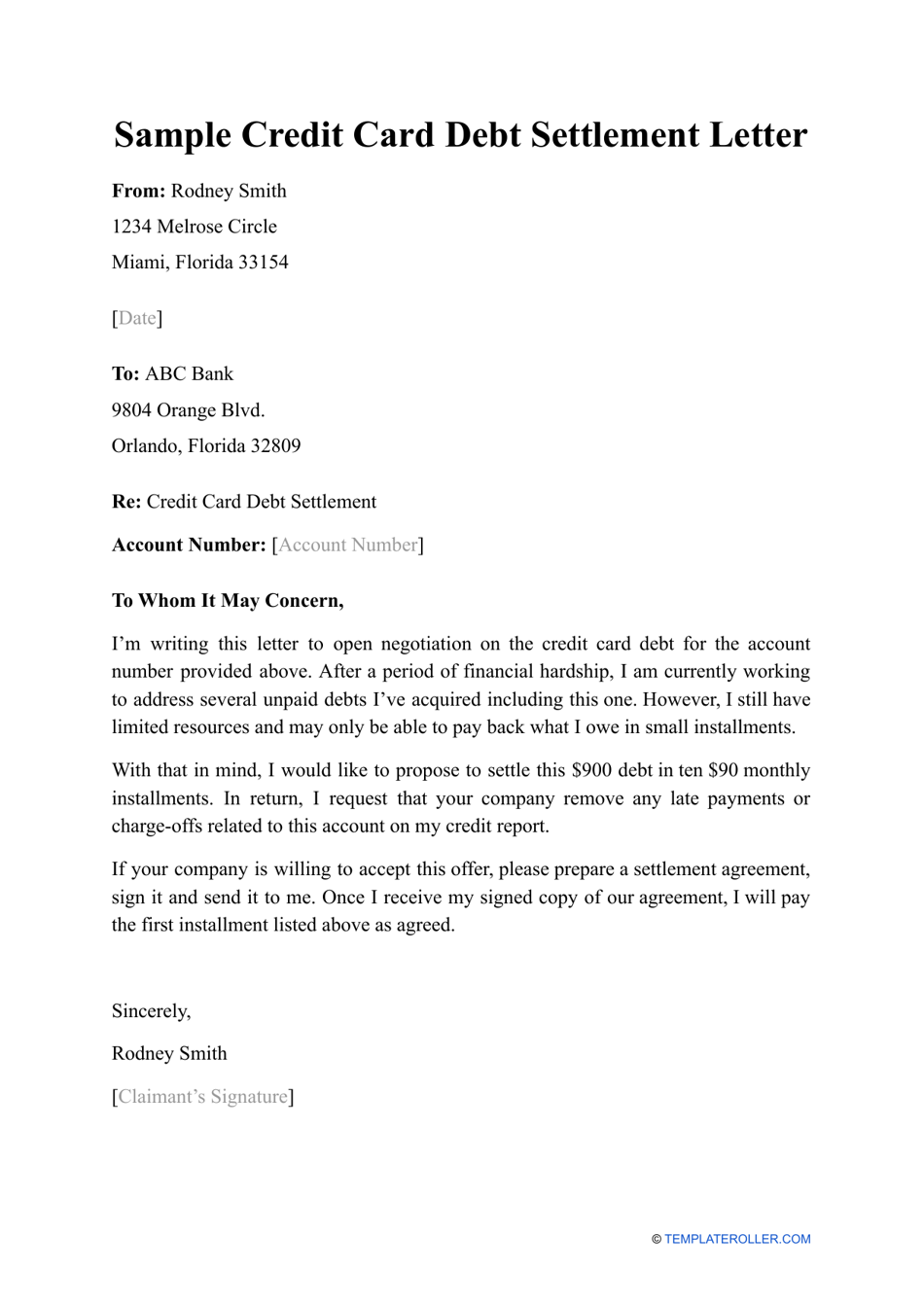

Sample Credit Card Debt Settlement Letter

A Credit Card Debt Settlement Letter is used when you are trying to negotiate the amount of money you will need to pay on an outstanding balance with a collection agency or credit card company. This type of letter is often written when you find you will be unable to repay the full amount of debt you owe and will need to negotiate a lower amount to settle the debt. A Sample Credit Card Debt Settlement Letter is available for download below.

To write a Credit Card DebtSettlement Letter you will want to include the following:

- The address of the agency managing your credit debt.

- Opening greeting and a statement explaining why you are requesting the settlement. Include the account number for reference.

- If the credit card debt has been moved to a collection agency, include the name of the credit card and its number. Also, detail the last time you made a payment on the card.

- To better help explain your financial situation, you can describe why you fell behind in payments (such as a loss of a job, severe illness, or other extenuating circumstance).

- Close by stating the amount you are able to pay immediately and provide your contact information.

- Closing salutation and signature.

Still looking for a particular template? Take a look at the related samples and templates below:

- Debt Forgiveness Letter Template;

- Sample Debt Forgiveness Letter;

- Sample Request for Debt Settlement Letter.

ADVERTISEMENT

Download Sample Credit Card Debt Settlement Letter

4.3 of 5 ( 23 votes )

ADVERTISEMENT

Linked Topics

Debt Assistance Credit Card Debt Overdue Payment Settlement Letter Debt Resolution Debt Consolidation Outstanding Balance Debt Collector Debt Negotiation Debt Management Debt Agreement Debt Relief Debt Settlement Late Payment Credit Score Collection Agency Debt Repayment Payment Plan Form Interest Rates Welfare Benefits Letters

Related Documents

- Sample Request for Debt Settlement Letter

- Debt Forgiveness Letter Template

- Sample Debt Forgiveness Letter

- Lump Sum Debt Settlement Letter Template

- Debt Settlement Offer Letter Template

- Mortgage Lien Release Form

- Car Accident Settlement Letter Template

- Sample Car Accident Private Settlement Letter

- Sample Car Accident Settlement Letter Without Insurance

- Mortgage Commitment Letter Template

- Sample Mortgage Pre-approval Letter

- Gift Letter for Mortgage Template

- Your Visa Signature Card Guide to Benefits: Wells Fargo Visa Signature Credit Card

- Debt Dispute Letter Template

- Sample Mortgage Loan Officer Interview Questions

- Sample Mortgage Loan Billing Statement

- Mortgage Loan Agreement Template

- Sample Dispute Letter to Credit Bureau

- Subordination Agreement Template

- Sample Hardship Letter for Loan Modifications

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.